The dollars and sense of car ownership: what does a car cost in real life?

Cars are often considered a ‘must-have’ but, at Uber Carshare, we like to challenge the culture of ‘one-person equals one-car’.

Have you ever looked closely at how much owning a car costs? By using our calculator, you can get informed and, from there, make choices about how car ownership does (or doesn’t) work for you.

Before we start crunching numbers, what do we need to consider?

How much is a car to buy and run? Let’s start with what are called ‘fixed costs’, which are things that stay the same no matter whether you use your car once a week or drive for hours every single day.

| Fixed Costs | How? |

|---|---|

| The car itself | The biggest single cost in buying a car is the purchase price. If you’re buying new, make sure you’re talking with the dealer about the total ‘drive away’ price rather than a figure that doesn’t include costs like stamp duty and dealer delivery. Buying second-hand will come with a lower price-tag but a greater degree of uncertainty about what repair costs might be needed down the track. |

| Depreciation | This is a fancy accounting term for the fact that cars lose value as they age. If you buy a car today that costs $20,000 and sell it in five years’ time for $12,000, it has depreciated by $8,000. You might dismiss this as an unimportant cost but that $8,000 is real money so should be taken into account when working out the cost of car ownership. |

| Registration | In all states of Australia, cars need to be registered. This might seem like you’re paying good money just for the privilege of owning a car but it’s worth remembering that these payments go towards important expenses like road infrastructure. |

| Compulsory third-party insurance (CTP) | We never like to think of the possibility of injuring someone while driving but it sadly does happen. Insurance that covers treatment and rehabilitation costs for anyone injured in a road accident is a non-negotiable cost for car owners. In some states, like Victoria, compulsory insurance is included with your registration. In other states, including NSW, you need to arrange and pay for this separately. Providers include AAMI, who offer CTP insurance quotes. |

| Interest | If you don’t have enough savings to buy your car, you’ll need to borrow money and that means paying interest on the loan. You can shop around for a good rate but, ultimately, this is money you wouldn’t be paying if you didn’t have a car so it needs to be considered within your total car expenses. |

Next, let’s look at costs that vary. These are often called ‘car running costs’ and include car maintenance costs.

| Variable Costs | How? |

|---|---|

| Fuel | Older family members might remember days when petrol cost less than 20 cents a litre but those days are long gone. With prices fluctuating closer to $2 per litre, the fuel cost of owning a car is no longer a small change. If you are considering electric car costs, you’ll have expenses associated with recharging instead of fuel. |

| Servicing | It’s important to look after major assets like your car. Servicing is when a mechanic checks everything is running smoothly as well as doing basic maintenance work like changing oil and filters. Ideally, cars are serviced every six months or after 10,000 of driving. If you buy a new car, the initial years of servicing might be included in the purchase price but after that time, and for all second-hand cars, you need to factor the cost of servicing into your budget. |

| Repairs | While servicing your car is a regular expense, there’s always a chance that something bigger might go wrong, in which case you’re looking at a repair bill. It’s harder to estimate these costs ahead of time but it’s worth having some money set aside so it’s less of a shock when something comes up. |

| Non-compulsory insurance | Compulsory third-party insurance is covered above but it’s wise to also take out optional car insurance. You can choose to insure yourself against damage to another person’s property (Third party property insurance), damage to your car caused by fire or theft (Fire and theft insurance) damage to your car no matter what the cause (Comprehensive insurance). Insurance costs might seem hefty but you need to consider the financial consequences of having an accident without being insured. |

| Roadside assistance | What would happen if your car breaks down far from home or work? Do you have the skills and the know-how to change a tyre by the roadside? If the idea of these questions makes you squirm, it’s worth joining a roadside assistance scheme - maybe one connected with your new car purchase or a state-based membership one, like NRMA, RACV or RACQ. |

| Tolls and parking | If you live outside a major city, you’ll have low or no costs for road tolls or parking. However, factor these costs in if you live in a busy place where you need to drive on toll roads or regularly pay for parking - where you live as well as where you work, shop and play. |

| Customisation and care | For some people, this is where the fun begins. Maybe you’re keen to make your wheels stand out from the crowd by getting a car wrap? Or, you want to make sure your car is always in tip-top condition by getting it cleaned or detailed? This care and customisation of your vehicle are great options but come with costs to consider. |

Let’s get calculating!

Now you’ve got a handle on the different costs associated with owning a car, you can certainly do some back of the envelope calculations. Or, you can stay online and use our Car Cost Calculator.

How does it work?

Jump online to https://blog.ubercarshare.com/car-cost-calculator/ and start entering numbers.

Let’s pop some typical figures into the six easy steps of the calculator:

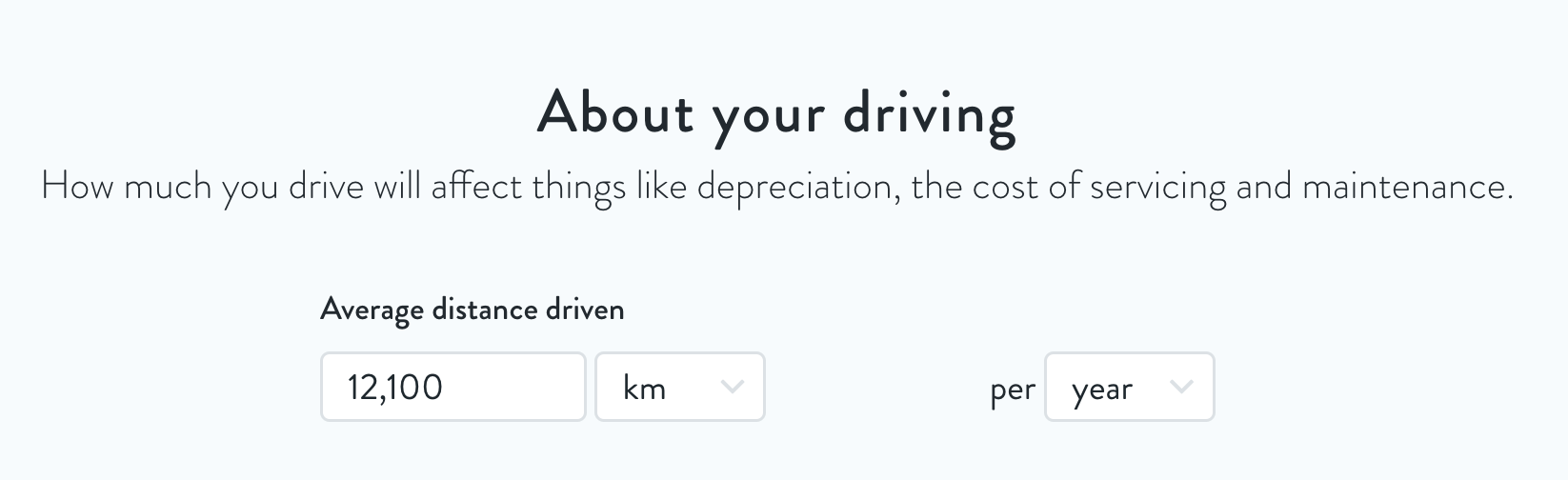

Distance

How far you drive affects your fuel costs as well as the overall cost of running a car. Do you drive 5,000 kilometres a year or 50,000? If a year feels like too big a time period to estimate, map your usual trips over a month and select ‘month’ rather than ‘year’ in the calculator. The Australian Bureau of Statistics tells us the average distance driven in a year is 12,100 kilometres, so let’s pop that figure into the calculator.

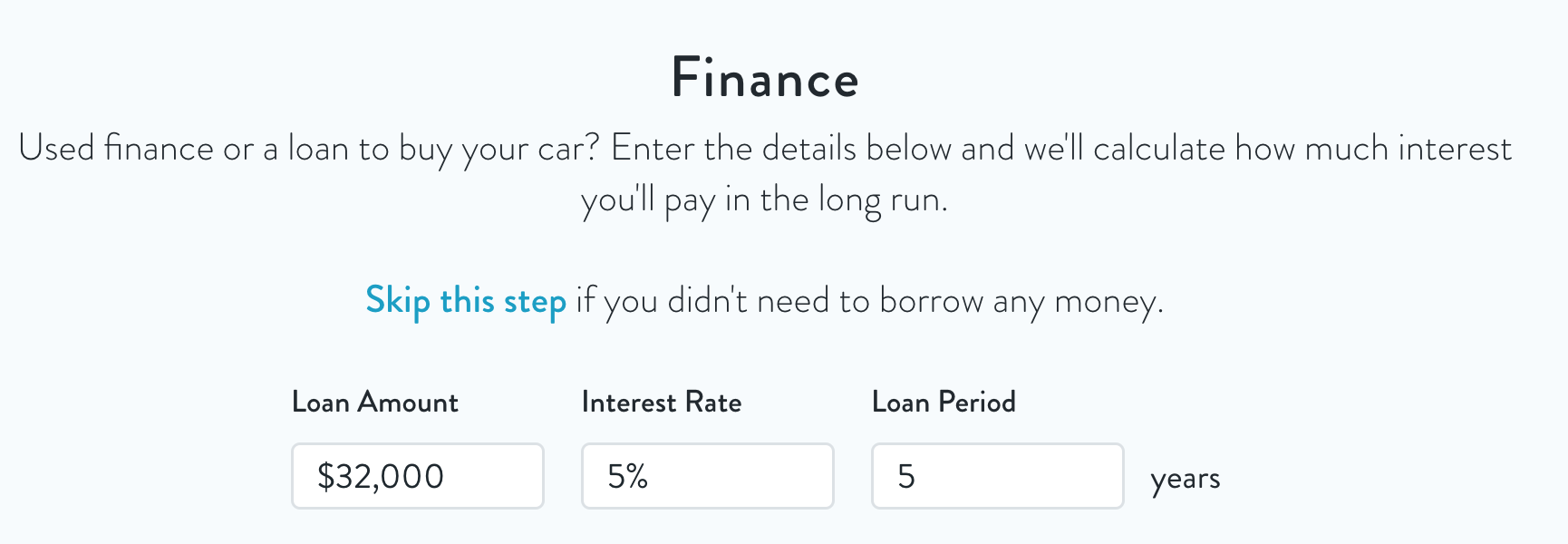

Finance

If you don’t need a loan to buy your car, click on the blue ‘Skip this step’. Otherwise, pop in your loan amount, interest rate and loan period. We’ll use a typical loan of $32,000 with an interest rate of 5% and a loan period of 5 years.

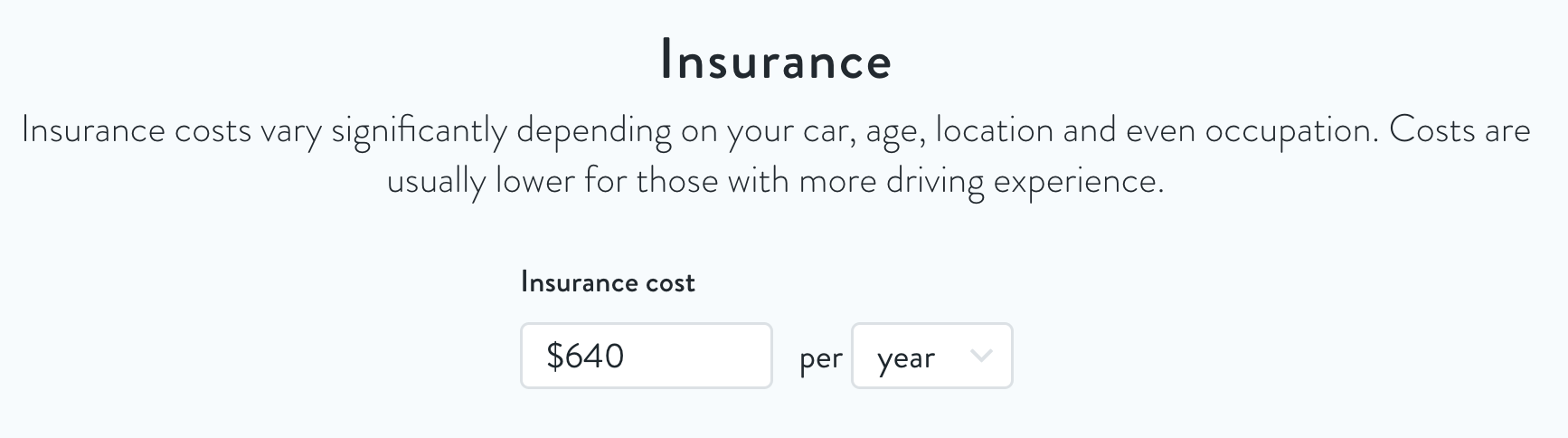

Insurance

This could range from a couple of hundred dollars (for an older car with a more experienced driver) to thousands. We’ll use an average figure of $640.

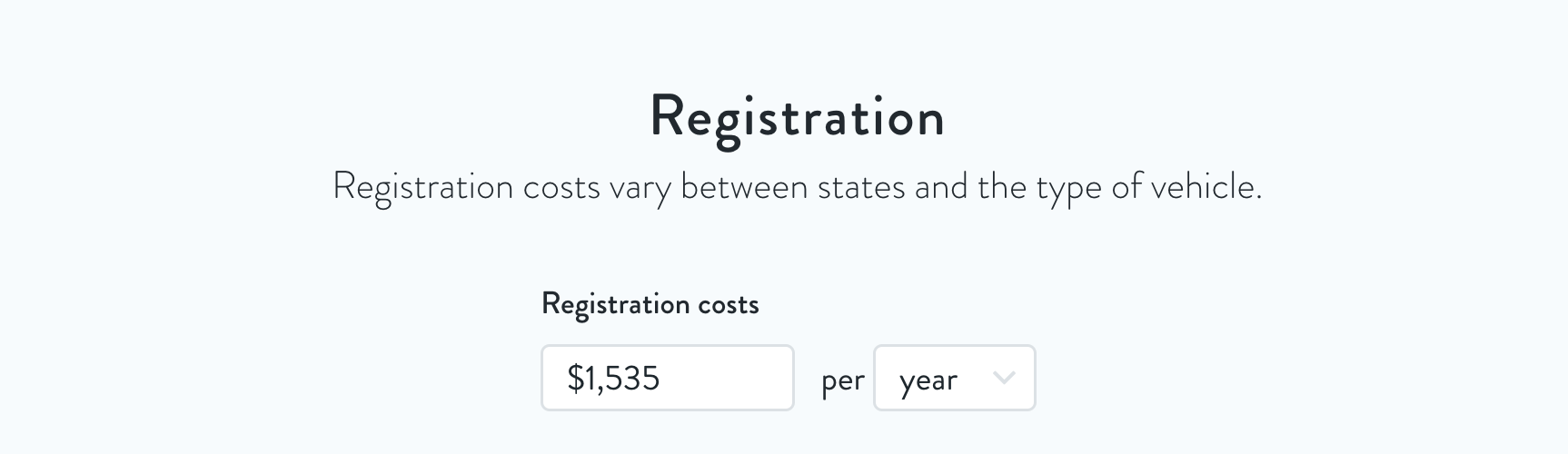

Registration

If you’re new to car ownership, a quick search of your state and type of vehicle will give you an estimate. Include compulsory third party insurance in this figure as well as the actual registration cost. We’ll go with $1,535 a year.

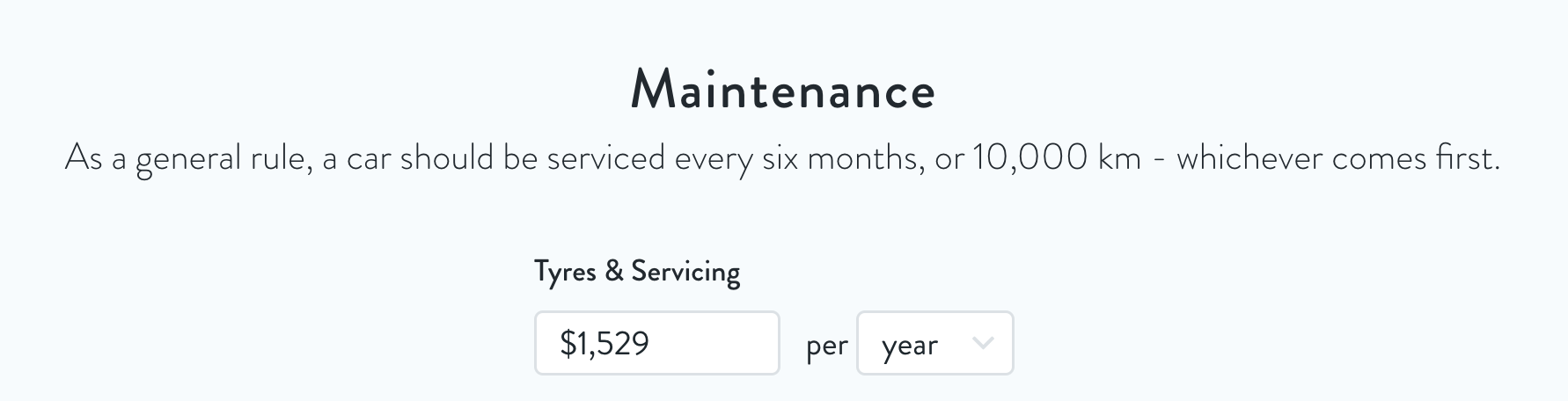

Maintenance

This figure is designed to include basic servicing and tyre replacements. For this exercise, let’s use $1,529 per year.

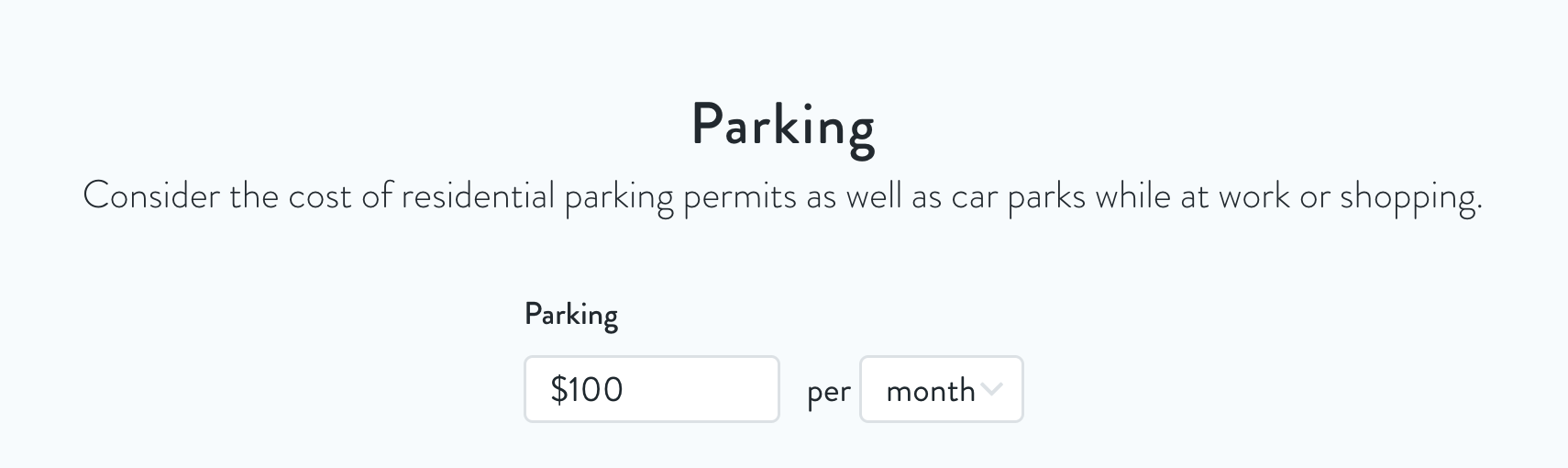

Parking

This might be anywhere between ‘zero’ and a scarily large amount. If you know you’ll be paying tolls regularly, including this amount here too. You can enter costs by month, quarter, six-months or full year. Let’s go with $100 per month.

Ready to see the outcome? Take a deep breath and click ‘View Results’.

The first figure you’ll see is the total cost over 5 years.

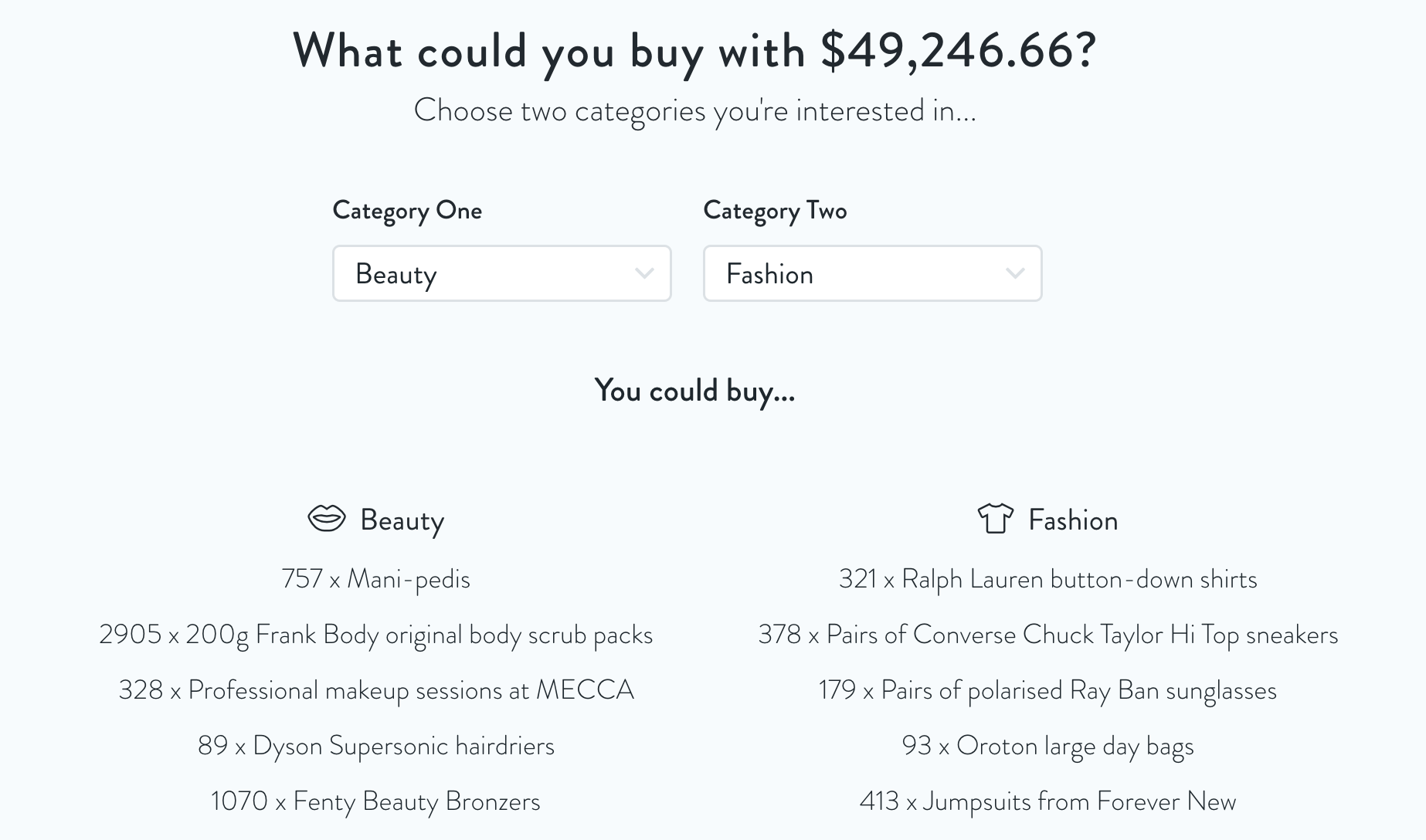

In this example we’ve used, this comes to a whopping $49,246.66.

Now comes another fun part - what else you could do with that money.

What else do you love? Maybe arts, beauty or fashion? How about food, gaming and home decor? Maybe you have savings needs or goals for learning or parenting? Maybe sports, tech or travel are on your radar?

Choose two of these interests and see what else your car costs could buy you.

Let’s start with Fashion and Gaming.

You’re unlikely to ever get through 378 pairs of Converse Hi Top sneakers but your fashion needs and wants would be well-covered with this sort of money.

And, you would have one heck of a party with 82 PlayStation consoles.

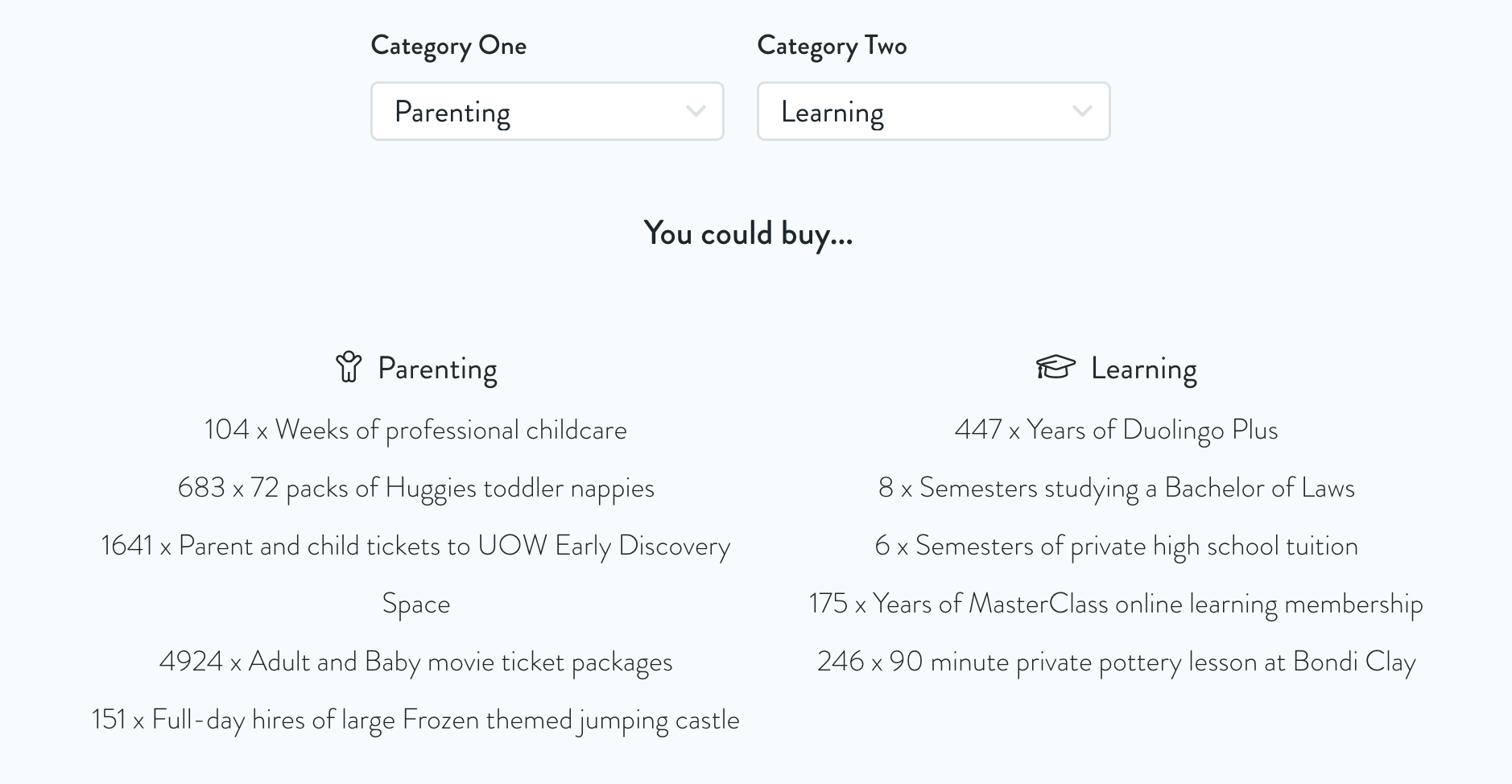

Let’s how look at how much your car costs would buy you in the Parenting and Learning spaces?

Not everyone would want 151 days of a Frozen-themed jumping castle (though we won’t judge if you do!) but 104 weeks of professional childcare is a serious expense.

Or, $49,000-plus can cover eight semesters of university study or enough Duolingo Plus to see you speaking multiple languages.

That’s more than I expected but I need a car. What choices do I have?

The Car Cost Calculator is a great tool to help you look at options within car ownership. You can re-use the calculator as many times as you like so you can use it to look at the impact of ways to save on car costs, like buying a cheaper car, spending less on parking, or saving more before buying so you don’t need to take out as big a loan.

Here are two other choices you may not have considered:

1. If you own a car but don’t need it all the time

The sharing economy is great for our planet and its people. If you rent your car out while it’s not needed - either from your home or during the day at work - you could both save someone else from having to buy a car and bring in some money!

Uber Carshare is used by a huge variety of people. Let’s meet some:

- Rowan is an environmental activist who’s not only happy that his electric car costs are covered by sharing it on Uber Carshare but that his borrowers don’t need to buy a car and take up valuable parking space.

- Issy is a uni student who was able to continue to afford to keep her much-loved car through sharing it with others.

- Ted is a veteran mechanic, who uses Uber Carshare to create a passive income.

Interested to hear more about becoming a Uber Carshare owner? Get the low down here.

2. If you’re ready to consider alternatives to car ownership

Not owning a car might seem like a radical decision but it’s radical for all the right reasons. Whether your motivation to be car-free is environmental or financial, it’s a choice that adds up. Not owning a car doesn’t mean you never drive one. Car sharing services like Uber Carshare allows you to use a car when you need one and not have to worry about garaging or paying for a vehicle when you don’t.

If you’re concerned about the loss of spontaneity and convenience of not having your own car, remember that you’ll also be free from the cost of owning a car, including unpredictable costs like repairs and rising fuel prices.

Uber Carshare is free to join and you can borrow your first car that same day! Will you save money by becoming a Uber Carshare borrower rather than a car owner? The simple answer is yes - this article shows you figures and allows you to hear about the experiences of happy borrowers.

Keen to find a Uber Carshare near you? Start searching now.

FAQs

What is the total cost of a car?

Car buying and running costs in Australia are more complex than just the purchase price plus the petrol you use. To understand the full cost, you need to consider things like registration, insurance, repairs and depreciation.

What is the running cost of a car?

Car running costs include petrol, servicing, repairs, optional insurances and expenses like parking fees.

How much does a car cost in Australia?

New cars in Australia cost anywhere between $15,000 to well over $100,000. Second hand car purchase prices range from a few hundred dollars to tens of thousands. When considering the cost of owning a car, other expenses such as registration, insurance, servicing and fuel also need to be considered.

What is the average cost of a car?

The average price of a new car is $40,000 and a second-hard car will cost anywhere from $5000 to tens of thousands. Don’t forget about all the other car costs to own too. You can even work out the per km cost of running a car in addition to the purchase price.

How much does a new car cost in 2022?

According to recent research, the average cost of a new car in Australia is just over $40,000. For people specifically looking for a small car, the average cost is closer to $25,000.

Is owning a car expensive?

Owning a car is more expensive than most people realise. Once you’ve bought a car, you need to pay registration and insurance. Plus, your car will be worth less down the track if you decide to sell it (a cost called depreciation). Then, there are running costs like fuel, servicing, repairs and parking.

How much is a car a month?

Some costs of owning a car only happen once (like buying the car), others happen once or twice a year (like registration and servicing) and others vary hugely depending on how much you drive (like fuel). Average costs have been estimated at between $700-$1000 per month but this can vary hugely.

How much can you afford for a car?

Before you rush out to buy a car, it’s important to be aware of all the costs you’ll be up for, not just the purchase price. Consider costs of fuel, repairs, servicing, registration and insurance as well as expenses like tolls and parking.